Streaming Services are a High-impact Channel for Brands in APAC

Share

21 April 2024

APAC video streaming has not only revolutionized the region’s film industry but also transformed consumer behavior. With the emergence of numerous platforms, viewers can now access content on any device, from mobile phones to large TV screens. This long-anticipated shift signifies an impressive change in how consumers engage with content, moving away from traditional television consumption via cable or satellite services.

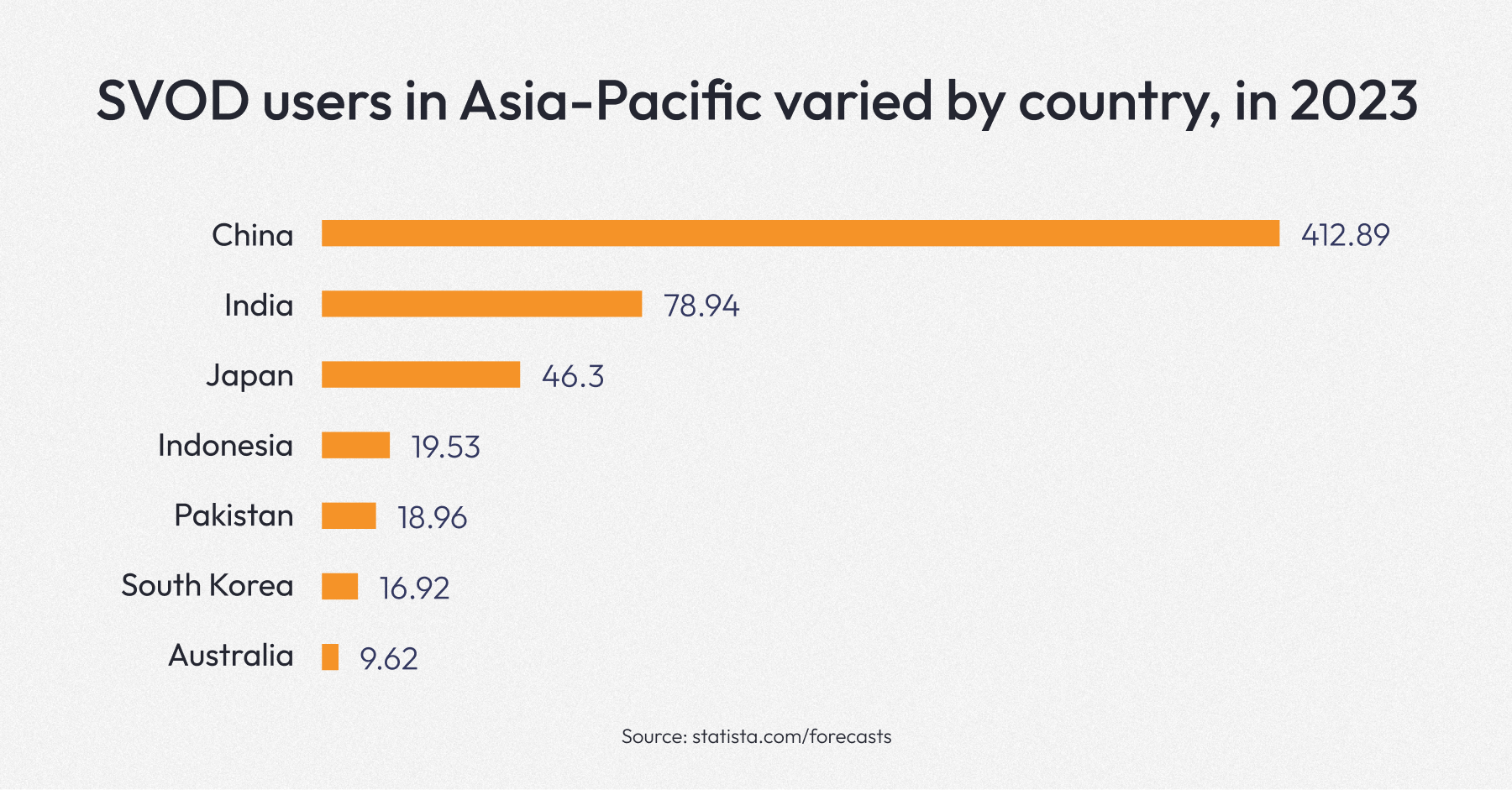

In the realm of video streaming (SVoD) segment, China boasts (statista.com) the largest market share with 412.89 million users, closely followed by India, which has 78.94 million users. The rise of video streaming platforms finding ways to accommodate APAC is akin to a vast river flowing through the entertainment landscape, carving new channels and connecting audiences in ways traditional TV cannot match.

SVOD users in Asia-Pacific varied by country, in 2023 (in millions)

Audiences of CTV in the APAC region

Streaming services in Asia-Pacific continue to extend. This is a game-changer for brands, offering them expanded opportunities to connect with their target audience. It reveals that over 70% of streaming ad viewers are comfortable sharing interests or demographic data for more relevant ads. This is encouraging news for advertisers and publishers aiming to craft personalized user ad experiences.

Furthermore, Connected TV (CTV) is anticipated to reach new heights, attracting fresh audiences. The affordability of devices, particularly in the CTV space, opens up numerous opportunities, potentially shifting emerging markets towards Smart TV-centric markets. While both mobile and TV streaming experiences rank highly, CTV stands out for its unique capacity to engage entire households, thereby broadening the addressable audience.

Let’s take a look at a couple of facts and numbers to ensure the prosperity of SVOD in the APAC region:

- Over the past few years, competition between internationally recognized and local platforms in the Asia-Pacific region has intensified significantly. The area’s subscription video-on-demand (SVOD) market shows significant variations in maturity levels.

- New Zealand is the sole country in the region to rank in the global top ten for user penetration, with Japan and Australia following closely within the top 15. These mature markets boast penetration rates exceeding 35%.

- In contrast, promising Southeast Asian markets like Indonesia and the Philippines are still in the early stages of SVOD adoption.

- China leads the region with over 400 million SVOD subscriptions, followed by India and Japan. Examining the most popular streaming services in these countries highlights the diverse landscape across APAC, with each nation showcasing its unique mix of leading SVOD providers – both international and local.

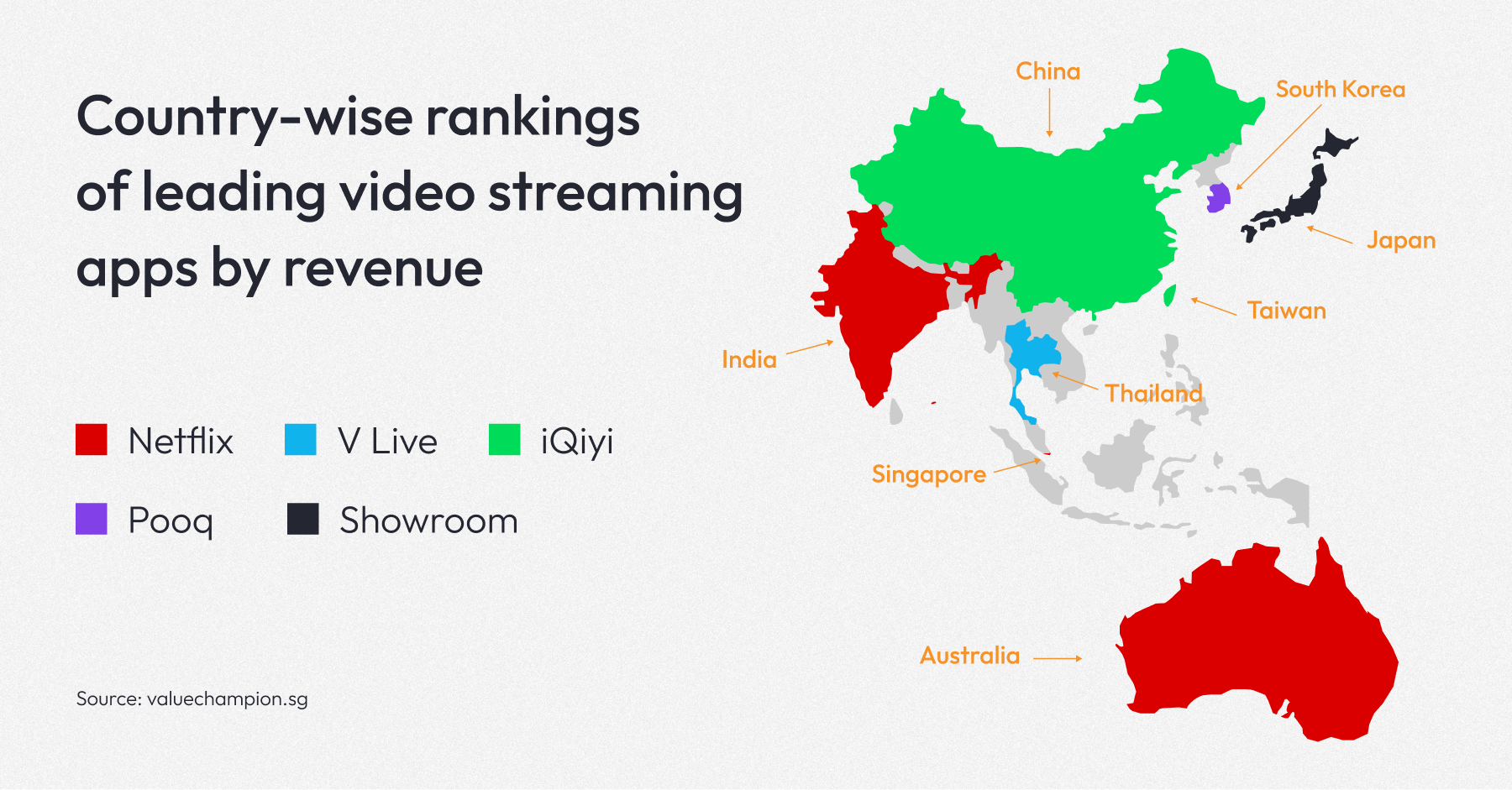

Top Video Streaming Apps & Revenue Boost Across the APAC region

In India, Netflix claims the top spot among streaming apps, followed closely by Hotstar TV. Similarly, Singapore and Hong Kong also favor Netflix, with Viu and Tencent Video making notable appearances. Thailand shows a preference for V Live alongside Netflix, while Taiwan leans towards iQiyi and KKTV. In China, iQiyi and Tencent Video dominate the streaming landscape. South Korea’s top choices include pooq and Whatcha Play, while Japan opts for Showroom alongside Netflix. Australia favors Netflix along with YouTube.

Country-wise rankings of leading video streaming apps by revenue

Additionally, the popularity of live streaming apps like V Live, Kitty Live, and Showroom is noteworthy across the region. These platforms, offering free usage, enable online celebrities to host live shows where viewers can support them through digital gifts. V Live, a product of South Korea’s internet giant Naver, has seen particular success in Asia by leveraging its access to famous Korean celebrities, highlighting the growing influence of interactive, celebrity-driven content in the streaming sphere.

It is worth noting that Disney+ Hotstar, previously one of the cheapest SVOD services in Southeast Asia, introduced a new premium tier priced nearly three times higher in markets like Indonesia and Thailand. In contrast, Netflix reduced monthly fees to encourage upgrades and introduced a member slot fee in select markets to monetize password sharing. These pricing strategies by major streaming providers in Southeast Asia aim to extract more value from subscribers as consumers become accustomed to paying for premium content access.

With the rising entrance of connected TVs in Southeast Asia, major content programmers like Disney and Warner Bros. Discovery Inc. are exploring the possibility of launching free ad-supported streaming TV channels. This strategy aligns with these regional companies’ closures of several linear TV channels, allowing them to monetize their content further and adapt to evolving viewer preferences.

Increase Premium Scale in Programmatic View

Given that DecenterAds is headquartered in Singapore, a significant number of our partners, including Tyroo, Ace, MetaX, TCL, BidMatrix, and others, are also situated within the APAC region. Many agency and brand clients choose our platform to achieve the scale and precise targeting they need while expanding their reach to diverse publishers. We provide access to over 100 premium demand sources and a wide range of publishers.

Programmatic advertising delivers the necessary scale and targeting for agencies and brands alongside expanded publisher reach. However, there’s a need to shift the traditional programmatic mindset. Brands and advertisers can execute their strategies with scale and precision through programmatic. However, we must emphasize that programmatic doesn’t equate to low cost because it can be premium due to engaged audiences during prime times.

While programmatic offers scalability, convincing clients to invest in it requires more effort. We must demonstrate the effectiveness of programmatic beyond impressions, focusing on generating sales and enhancing brand perception. With the emergence of programmatic advertising, data activation, and the potential of streaming services, advertisers are entering an exciting phase with new opportunities to craft engaging ad experiences for consumers and achieve results in the premium streaming environment.

Streaming Trends in the APAC Region

Ad-supported streaming services in Southeast Asia now command a viewership of 71%, closely approaching the 75% viewership rate of traditional TV. In total, 88% of viewers engage with some streaming service, highlighting the growing popularity and impact of ad-supported streaming platforms in today’s media landscape. This data underscores the shifting dynamics of viewer preferences towards digital streaming options alongside traditional television.

Southeast Asian viewers demonstrate a solid commitment to streaming content, with 43% regularly binge-watching multiple TV show episodes in one sitting and another 43% tuning in to watch new episodes at scheduled streaming times.

Future viewing intentions indicate a significant shift towards increased streaming across the APAC streaming market. In Singapore, 50% plan to watch more streaming content next year, while in Indonesia, the figure rises to 56%. Vietnam shows even stronger intent, with 67% planning to increase watch streaming, followed by the Philippines at 69% and Thailand at 78%.

Ad-supported viewers consume TV content across various devices, with a notable uptick in smart TV usage. In a typical week, 67% of this audience consistently watch content on a smart TV, while a higher percentage, 82%, watch on a smartphone. This data highlights the shift towards multi-device viewing habits among ad-supported viewers, where smartphones remain a dominant platform alongside the rising popularity of smart TVs.

In Southeast Asia, 94% of ad-supported streamers are highly inclined to purchase from a brand they interacted with across multiple devices, including TV, mobile, and desktop. This statistic underscores the importance of cross-device engagement in influencing consumer behavior and purchase decisions within the region’s ad-supported streaming audience.

Streaming platforms provide a premium advertising environment that significantly impacts brands. A striking 90% of ad-supported streamers report discovering new products and services through ads on these platforms, with 68% taking subsequent action. Additionally, streaming services surpass videos on social media across various stages of the purchase journey, demonstrating their effectiveness in driving consumer engagement and conversions for advertisers. This data underscores the value and efficacy of advertising on streaming platforms for brand discovery and consumer action.

Ad-supported streamers have clear preferences for ad duration per hour:

- 64% find up to 5 minutes of ads per hour acceptable.

- 24% are comfortable with 6–10 minutes of ads.

- 7% are tolerant of 11–15 minutes of ads.

- 5% will accept 16–20 minutes of ads per hour.

These findings highlight the thresholds for ad duration that are generally acceptable among ad-supported streaming audiences.

According to Forbes, Netflix’s dominance in the streaming service market is indisputable. The company boasts an impressive total of 260.28 million subscribers worldwide, a notable 5.3% increase from the previous quarter and a remarkable 13% growth year over year. The substantial growth in the Asia-Pacific region is particularly noteworthy, with an additional 45.3 million subscribers. This highlights Netflix’s strong global presence and ongoing expansion into key markets.

Summary

Expanding video streaming services in the Asia-Pacific region has transformed the entertainment landscape and presented significant opportunities for brands to engage with consumers. This shift from traditional TV consumption to streaming platforms has been especially pronounced in China and India, where millions of users access content across various devices.

Online TV evolved in APAC, allowing advertisers to engage entire households. The region’s SVOD market varies in maturity, with countries like New Zealand, Japan, and Australia showing high penetration rates, while others like Indonesia and the Philippines are still in the early stages of adoption.

Programmatic advertising is gaining ground in APAC, offering scalability and precise targeting. Ad-supported streaming platforms are increasingly impactful for brands, with many viewers discovering new products through ads and showing a willingness to engage with brands across multiple devices.

The future of streaming in APAC looks promising, with viewers strongly intending to increase their streaming consumption. This shift underscores understanding and leveraging streaming platforms for brands to reach and engage with regional audiences.

Stay up to date with our company news

04 April 2024

Ad servers are a part of advertising technology employed by publishers and advertisers. Their main role is to manage, distribute, and monitor online advertisements efficiently. They act as a central hub and ensure the seamless delivery of ads to website visitors and mobile app users. Ad servers are important components […]

20 March 2024

The PlayFronts, organized by the International Advertising Bureau, is an annual event that acts as a beacon for demonstrating the potential of advertising and joint projects in the dynamic gaming field. This event aims to define the gaming landscape, highlight gaming’s effectiveness, and present creative opportunities for brands. It brings […]

13 March 2024

Paramount, which holds this year’s Super Bowl broadcasting rights, is airing the game on CBS and Nickelodeon. Additionally, it will stream the event on Paramount+ for the first time. Super Bowl ad units have been bundled across CBS, Paramount+, and Nickelodeon (excluding some categories), ensuring comprehensive omnichannel campaigns. Paramount’s debut […]